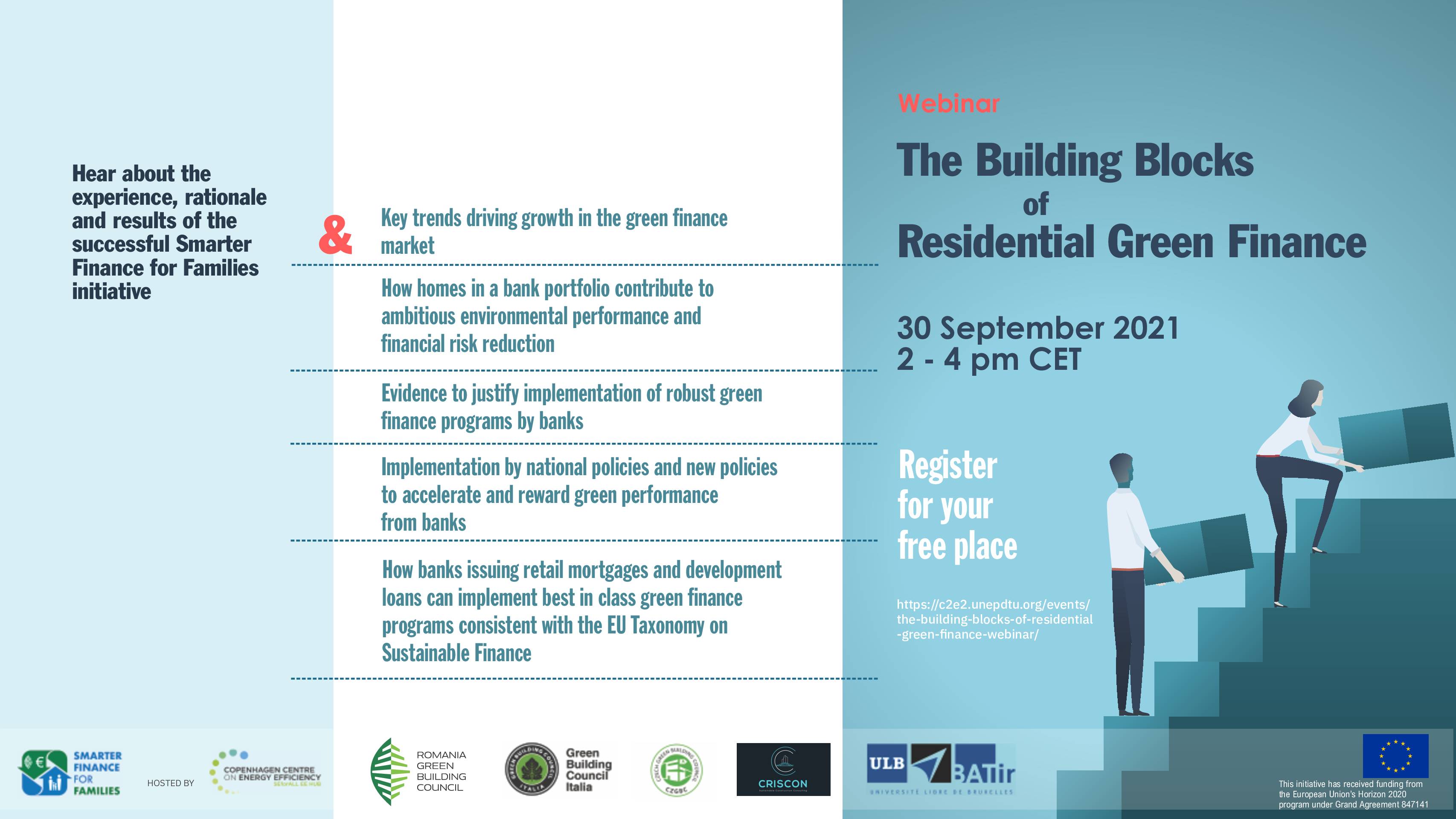

The Building Blocks of Residential Green Finance – the rationale, methodology, and initial results of implementing a successful, international residential green finance program to benefit our citizens, the planet, and a climate-ready banking sector.

- What key trends are driving the substantial growth in the green finance market?

- How do homes in a bank portfolio contribute to both ambitious environmental performance and substantial financial risk reduction?

- What research and evidence is available to justify banks implementing robust green finance programs?

- What national policies are being implemented and what new proposed policy can accelerate and reward green performance from the banking industry?

- Learn how banks issuing retail mortgages and development loans can implement best-in-class green finance programs that are consistent with the EU Taxonomy for Sustainable Finance.

Agenda

- Overview of how Green Homes & Green Mortgages programmes work and the SMARTER Finance for Families initiative

- Policies to support the growth of residential green finance

- Key research created by SMARTER to support residential green finance

- Next steps. Ways to get involved/participate in advancing the green finance topic

Share this

Sector: Buildings

Country / Region: Belgium, Czech Republic, Global, Italy, Romania

Tags: citizens, drives, green finance, international development, loans, national policies, risks, SMARTER, specific financing mechanismsIn 2 user collections: SMARTER – Events , C2E2 Webinars

Knowledge Object: eLearning

Published by: Copenhagen Centre on Energy Efficiency

Publishing year: 2021

Content:

- The SMARTER Finance for Families initiative; European Advisory Board

- Toward Net-Zero Real Estate; Policy Blueprint

- Key research created by SMARTER to support residential green finance

- The Financial Valuation of Green Homes

- The SMARTER Finance for Families initiative; Consistent Tools for Assessing and Reporting